Riding the Bull, Eluding the Bear

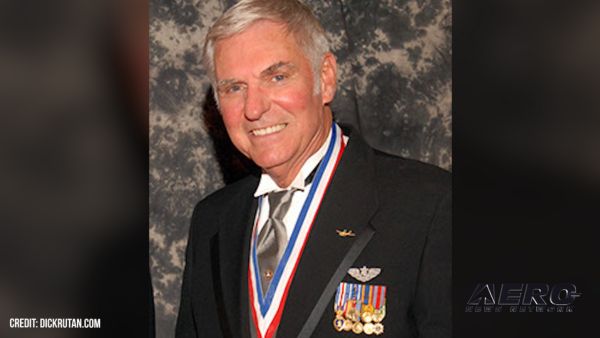

Formed in 2006 by Brian Foley, a former Boeing flight test engineer and twenty-year Dassault Falcon Jet marketing director, Sparta, New Jersey’s Brian Foley Associates (BRiFO) is a respected consultancy diligently about the business of providing aerospace firms and investors strategic research and guidance.

On 03 January 2023, Mr. Foley penned an intriguing essay in which he posits the private aviation sector may be headed for a slump. Here follow a number of key passages excerpted from subject essay, to which Mr. Foley ascribed the gloomy if not arguably apposite title Private Aviation’s Sudden Popularity Falls Back to Earth:

“Fueled since 2020 by soaring personal stock portfolios, easy access to low-interest cash and a pandemic-induced desire to avoid public airport cattle stalls, interest in flying privately has soared. However recent metrics now suggest the white-hot market has begun to cool to a more manageable and sustainable level.

“Shortly after the pandemic was declared, first-time users of private aircraft began to flock to the easiest access to personal flights—charter and fractional aircraft providers … Some charter providers reported upwards of fifty-percent of their business being booked by new clients who had never flown privately before.

“… Buying a used aircraft was another way for newcomers with the resources and commitment to take to the skies on their own terms. This trend proved so popular as to empty the supply of used aircraft on the market to all-time lows. This predictably caused prices to surge as it promptly became a seller’s market, often leaving only the choice of older, overpriced, ugly duckling jets with a laundry list of expensive maintenance requirements.

“This frustration led some first-time buyers to the most expensive solution of them all—buying a brand-new plane. Just as the charter, fractional and pre-owned markets were inundated, so too had the manufacturers’ order books begin to swell. In 2021 Textron Aviation, maker of such private aircraft as the Cessna Citation business jet and King Air turboprop, reported that twenty-percent of their customers were new to ownership. This sudden surge in interest caused the next-available buyer delivery slots to extend out to the 2025 timeframe and beyond at some manufacturers.

“As with any extreme swings from market norms, these exceptional times weren’t to last forever. Early signs of the froth receding a bit—not catastrophically but in a manner that relieves an overworked market—have begun to appear.

“… After a string of record-setting years, the association for the preowned aircraft market IADA reported a six-percent decrease in sales transactions year-to-date through the third quarter in 2022 compared with the same period in 2021. Further decreases are likely to be in store as the one-hundred-percent accelerated U.S. tax depreciation benefit decreases to eighty-percent in 2023 and even less beyond making the ownership proposition less compelling to certain buyers.

“New business jet makers have been seeing the recent downshift as well, as book-to-bill ratios, a measure of sales activity, declined somewhat. Despite this, backlogs have already swelled to multi-year highs, equivalent to a couple of years’ production. Benefitting are such OEMs as Dassault, Bombardier, Gulfstream, Embraer and Textron’s aviation division.

“The reduction in charter activity coupled with fewer new and pre-owned aircraft sales indicates the peak has passed for the general public’s discovery and fascination with private aviation. This is frankly a relief for an industry that was never scaled to be a mass transit system and has been overwhelmed over the last couple of years.

“The shift won’t come without some longer-term risks. Fractional providers, having been unable to meet the surge in demand for their charter programs, placed massive new airplane fleet orders with manufacturers. The stickiness of these orders remains to be seen as aviation newcomers become fewer and farther between. Another crack that could appear are for those charter/fractional companies that depend heavily on client growth to make their numbers or satisfy investors.

“Regardless, my estimate is that less than 10% of those new to general aviation will remain in the fold, which still favorably raises the baseline obtainable market for the industry from this point forward. It took nothing less than a pandemic to finally shake this low-hanging fruit from the tree.”

Those financially scarred by the 2008 global financial crisis—the worst economic downturn since the Great Depression—will no doubt note disconcerting parallels between it and Mr. Foley’s assessment of the contemporary private aircraft market. Succinctly laid out in a few paragraphs, the folly of plenitude in perpetuity appears glaringly self-evident. In real-time, however, viewed against a backdrop of spiking demand and many, many black zeros, avaricious OEMs are wont to conflate the intoxication of full order books with the nourishment of monies banked.

Notwithstanding the fact that the future is eminently unknowable, Mr. Foley’s sentiments merit consideration.

ANN's Daily Aero-Term (05.02.24): Touchdown Zone Lighting

ANN's Daily Aero-Term (05.02.24): Touchdown Zone Lighting Aero-News: Quote of the Day (05.02.24)

Aero-News: Quote of the Day (05.02.24) Aero-News: Quote of the Day (05.03.24)

Aero-News: Quote of the Day (05.03.24) ANN's Daily Aero-Term (05.03.24): UAS Traffic Management (UTM)

ANN's Daily Aero-Term (05.03.24): UAS Traffic Management (UTM) ANN's Daily Aero-Linx (05.03.24)

ANN's Daily Aero-Linx (05.03.24)