Mon, May 19, 2003

Advertisement

More News

ANN's Daily Aero-Linx (05.04.24)

ANN's Daily Aero-Linx (05.04.24)

Aero Linx: JAARS Nearly 1.5 billion people, using more than 5,500 languages, do not have a full Bible in their first language. Many of these people live in the most remote parts of>[...]

NTSB Final Report: Quest Aircraft Co Inc Kodiak 100

NTSB Final Report: Quest Aircraft Co Inc Kodiak 100

'Airplane Bounced Twice On The Grass Runway, Resulting In The Nose Wheel Separating From The Airplane...' Analysis: The pilot reported, “upon touchdown, the plane jumped back>[...]

Aero-News: Quote of the Day (05.04.24)

Aero-News: Quote of the Day (05.04.24)

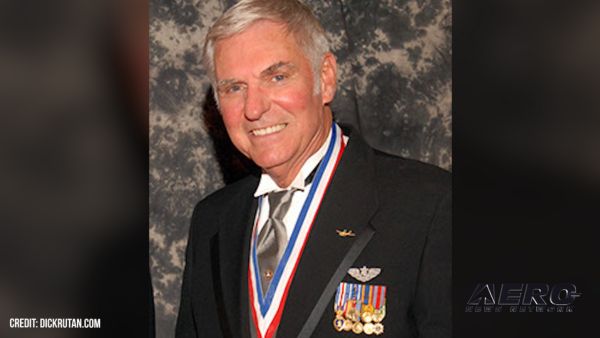

"Burt is best known to the public for his historic designs of SpaceShipOne, Voyager, and GlobalFlyer, but for EAA members and aviation aficionados, his unique concepts began more t>[...]

Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24)

"Polaris Dawn, the first of the program’s three human spaceflight missions, is targeted to launch to orbit no earlier than summer 2024. During the five-day mission, the crew >[...]

Read/Watch/Listen... ANN Does It All

Read/Watch/Listen... ANN Does It All

There Are SO Many Ways To Get YOUR Aero-News! It’s been a while since we have reminded everyone about all the ways we offer your daily dose of aviation news on-the-go...so he>[...]

blog comments powered by Disqus