Wed, Dec 31, 2008

Advertisement

More News

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

Omnidirectional Approach Lighting System ODALS consists of seven omnidirectional flashing lights located in the approach area of a nonprecision runway. Five lights are located on t>[...]

Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24)

"Polaris Dawn, the first of the program’s three human spaceflight missions, is targeted to launch to orbit no earlier than summer 2024. During the five-day mission, the crew >[...]

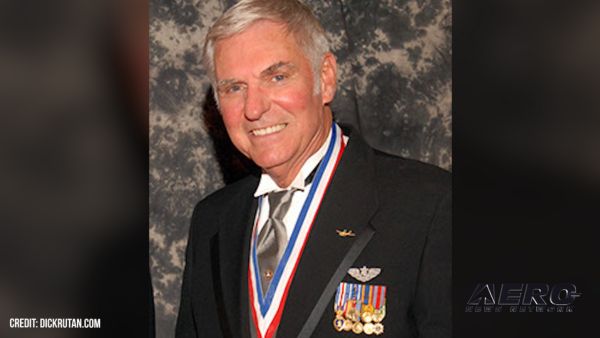

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Also: 1800th E-Jet, Uncle Sam Sues For Landing Gear, Embraer Ag Plane, Textron Parts A friend of the family reported that Lt. Col. (Ret.) Richard Glenn Rutan flew west on Friday, M>[...]

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Also: Virgin Galactic, B-29 Doc to Allentown, Erickson Fire-Fighters Bought, FAA Reauthorization After dealing with a big letdown after the unexpected decision by Skyreach to disco>[...]

Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)

“Our aircrews are trained and capable of rapidly shifting from operational missions to humanitarian roles. We planned to demonstrate how we, and our BORSTAR partners, respond>[...]

blog comments powered by Disqus