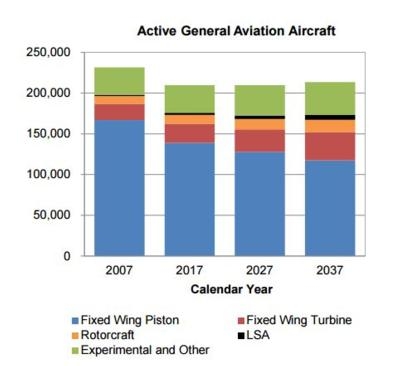

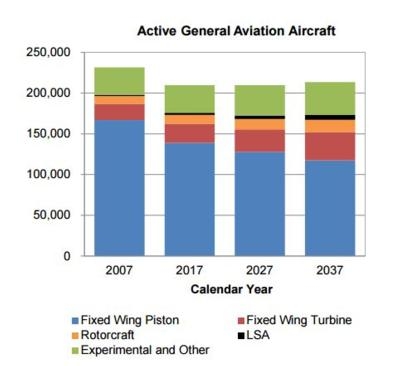

Number Of Piston-Engine Airplanes Expected To Decline Through The Period

The FAA has released its 20-year forecast for 2017-2037, and the outlook does not look good in the fixed-wing piston-engine segment of the industry.

According to the report's executive summary, the long term outlook for general aviation is stable to optimistic, as growth at the high end offsets continuing retirements at the traditional low end of the segment. The active general aviation fleet is forecast to increase 0.1 percent a year between 2016 and 2037, resulting in an increase in the fleet of about 3,400 units.

While steady growth in both GDP and corporate profits results in continued growth of the turbine and rotorcraft fleets, the largest segment of the fleet – fixed wing piston aircraft continues to shrink over the forecast. The number of fixed wing piston aircraft is predicted to shrink over the forecast period by 22,500 aircraft (at an average annual rate of -0.8 percent). Unfavorable pilot demographics, overall increasing cost of aircraft ownership, coupled with new aircraft deliveries not keeping pace with retirements of the aging fleet are the drivers of the decline.

Although overall fleet growth is minimal, the number of general aviation hours flown is projected to increase an average of 0.9 percent per year through 2037, as growth in turbine, rotorcraft, and experimental hours more than offset a decline in fixed wing piston hours.

With increasing numbers of regional and business jets in the nation’s skies, fleet mix changes, and carriers consolidating operations in their large hubs, the FAA says it expects increased activity growth which has the potential to increase controller workload. Operations at FAA and contract towers are forecast to increase 0.8 percent a year over the forecast period with commercial activity growing at five times the rate of noncommercial activity. The growth in U.S. airline and business aviation activity is the primary driver. Large and medium hubs will see much faster increases than small and non-hub airports, largely due to the commercial nature of their operations.

For airlines, the 2017 FAA forecast calls for U.S. carrier passenger growth over the next 20 years to average 1.9 percent per year, slightly slower than last year’s forecast. The sharp decline in the price of oil in 2015-16 was a catalyst for an uptick in passenger growth in 2016 that will continue into 2017. The price of oil is projected to rise from around $39 per barrel in 2016 to $47 in 2017, and the FAA forecast assumes that it will rise thereafter to exceed $100 by 2026 and approach $132 by the end of the forecast period.

There are a number of headwinds that are buffeting the global economy – uncertainty surrounding “Brexit”, recession in Russia and Brazil and inconsistent performance in other emerging economies, a “hard landing” in China, and lack of further stimulus in the advanced economies. Although the U.S. economy has managed to avoid a recession, there is uncertainty regarding the impact of the new U.S. administration’s policies on economic growth.

System traffic in revenue passenger miles (RPMs) is projected to increase by 2.4 percent a year between 2017 and 2037. Domestic RPMs are forecast to grow 2.0 percent a year while International RPMs are forecast to grow significantly faster at 3.4 percent a year. U.S. carrier system capacity measure in available seat miles (ASMs) is forecast to grow in line with the increases in demand. The number of seats per aircraft is getting bigger, especially in the regional jet market, where we expect the number of 50 seat regional jets to fall to just a handful by 2023, replaced by 70-90 seat aircraft.

(Graphic from FAA report. Other image from file)

Bolen Gives Congress a Rare Thumbs-Up

Bolen Gives Congress a Rare Thumbs-Up The SportPlane Resource Guide RETURNS!!!!

The SportPlane Resource Guide RETURNS!!!! Buying Sprees Continue: Textron eAviation Takes On Amazilia Aerospace

Buying Sprees Continue: Textron eAviation Takes On Amazilia Aerospace Hawker 4000 Bizjets Gain Nav System, Data Link STC

Hawker 4000 Bizjets Gain Nav System, Data Link STC Echodyne Gets BVLOS Waiver for AiRanger Aircraft

Echodyne Gets BVLOS Waiver for AiRanger Aircraft