Company Names Board Members, Begins Trading on NYSE as UAL

Friday

United Continental Holdings, Inc., formerly UAL Corporation,

announced Friday that a wholly owned subsidiary has merged with

Continental Airlines, Inc., and that Continental Airlines and

United Air Lines, Inc. are now wholly owned subsidiaries of United

Continental Holdings, Inc. The common stock of United Continental

Holdings, Inc. began trading on the New York Stock Exchange under

the symbol UAL Friday.

United Continental Holdings, Inc., formerly UAL Corporation,

announced Friday that a wholly owned subsidiary has merged with

Continental Airlines, Inc., and that Continental Airlines and

United Air Lines, Inc. are now wholly owned subsidiaries of United

Continental Holdings, Inc. The common stock of United Continental

Holdings, Inc. began trading on the New York Stock Exchange under

the symbol UAL Friday.

United Continental Holdings, Inc. also announced the members of

its board of directors, effective October 1, 2010. The 16-member

board includes six independent directors from each of United and

Continental, Glenn Tilton, who will serve as non-executive chairman

of the board, and Jeff Smisek, who will serve as president and

chief executive officer. The independent directors are

Kirbyjon H. Caldwell, Carolyn Corvi, W. James Farrell, Jane C.

Garvey, Walter Isaacson, Henry L. Meyer III, Oscar Munoz, James J.

O'Connor, Laurence E. Simmons, David J. Vitale, John H. Walker and

Charles A. Yamarone. Additionally, the board has two union

directors: Stephen R. Canale and Captain Wendy J.

Morse.

"This is a true merger of equals, bringing together two strong

companies and positioning us to succeed in a dynamic and highly

competitive global aviation industry. This sets us on a path to

create the world's leading airline from a position of strength,

with one of the the industry's best cash positions,

industry-leading revenues and a competitive cost structure," Tilton

said. "Drawing from both companies, we have an excellent board of

directors and a strong management team, and we have the industry's

best people to deliver on the promise of great products and service

for our customers, career opportunities for our people and

consistent returns for our shareholders."

With approximately $9 billion in unrestricted cash at closing,

United expects the merger will deliver $1.0 billion to $1.2 billion

in net annual synergies by 2013, including between $800 million and

$900 million of incremental annual revenue, from expanded customer

options resulting from the greater scope and scale of the network,

fleet optimization and expanded service enabled by the broader

network of the combined carrier. On a pro-forma basis, the combined

company would have annual revenues of $31.4 billion, based on

results for the 12 months ending June 30, 2010.

With approximately $9 billion in unrestricted cash at closing,

United expects the merger will deliver $1.0 billion to $1.2 billion

in net annual synergies by 2013, including between $800 million and

$900 million of incremental annual revenue, from expanded customer

options resulting from the greater scope and scale of the network,

fleet optimization and expanded service enabled by the broader

network of the combined carrier. On a pro-forma basis, the combined

company would have annual revenues of $31.4 billion, based on

results for the 12 months ending June 30, 2010.

Continental and United, operating under United Continental

Holdings, Inc., will immediately begin the work to fully integrate

the two companies. In the near term, customers can expect to

interact with each carrier as they always have. Customers flying on

Continental will continue to check in at continental.com, or at

Continental kiosks and ticket counters, and to be assisted by

Continental employees, and customers flying on United will continue

to check in at united.com or at United kiosks or ticket counters,

and to be assisted by United employees. Customers will continue to

earn and redeem frequent-flier miles through the respective loyalty

programs of Continental and United until those programs are

combined. The company expects that travelers will begin to see a

more unified product in the spring of 2011, as the carriers

integrate key customer service and marketing activities to deliver

a more seamless product.

"Today's merger closing is a big first step, and I want to thank

my co-workers at Continental and United for their incredible

efforts to get us to this point," Smisek said. "We have been moving

quickly but thoughtfully on our integration planning, and I'm

pleased with the progress we've made. We have a lot of hard

work ahead as we begin to implement our integration plan, but our

co-workers are enthusiastic about the opportunities this merger

will bring to them."

The new company creates a platform for greater job stability,

career opportunities, and retirement security for its employees by

being part of a larger, financially stronger and more

geographically diverse carrier that is better able to compete

successfully in the global marketplace.

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System Aero-News: Quote of the Day (05.05.24)

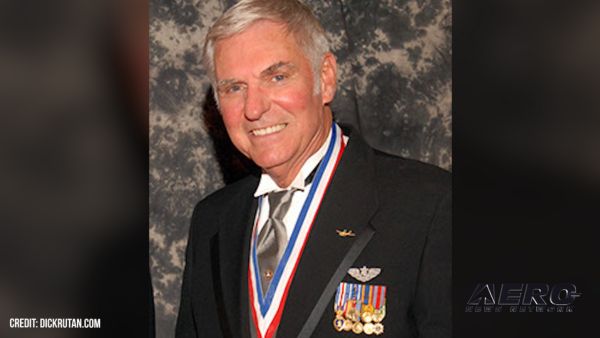

Aero-News: Quote of the Day (05.05.24) Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)