Sales Data For Business Jet, Business Turboprop Aircraft,

Helicopters

February sales trends for pre-owned business jet, business

turboprop, and helicopter markets have been released by JetNet, a

corporate aviation information service. The company says the data

shows that the reality is the current business down cycle will last

longer than the industry would like, but the good news is that the

business aircraft and helicopter markets are mostly on the right

track. The company finds that slow domestic sales are continue to

have a significant impact on the inventory of existing bizjets.

February sales trends for pre-owned business jet, business

turboprop, and helicopter markets have been released by JetNet, a

corporate aviation information service. The company says the data

shows that the reality is the current business down cycle will last

longer than the industry would like, but the good news is that the

business aircraft and helicopter markets are mostly on the right

track. The company finds that slow domestic sales are continue to

have a significant impact on the inventory of existing bizjets.

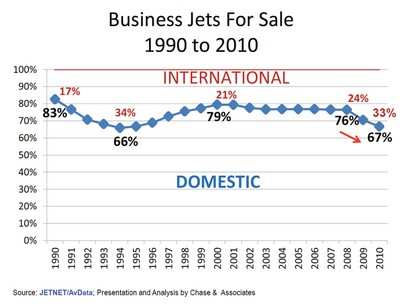

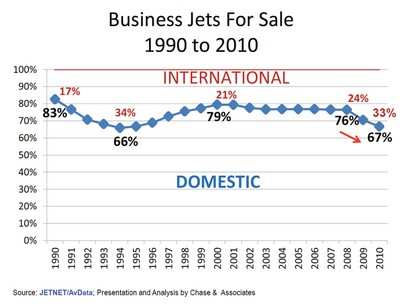

During the decade of the 1990s the ratio ranged from a high of

83/17 to a low of 66/34 and then increased again to 79/21 for much

of the decade of the 00s. However, starting in 2008 this ratio

declined rapidly over a two-year period, ending with a 67/33 ratio

in 2010 (Chart A). In our view, this change in direction has had an

impact on the stubbornly high For Sale inventory levels we

witnessed throughout 2010.

Chart A

Examining he key worldwide trends across all aircraft market

segments, comparing February 2011 to February 2010 (Table A),

business jet inventory percentage For Sale showed the largest

change (down 1.4 points), to 14.4% from 15.8%. Both turbine and

piston helicopter sectors were basically unchanged in percentage

For Sale for February 2011 compared to 7% for the same period in

2010

Business Jet Sale Transactions increased 17.2% YTD in February

2011 compared to the same period in 2010. Business turboprops also

showed a positive change of 10.4%. Both helicopter categories saw

large double-digit declines in sale transactions (down 31% for

turbine and 28.5% for piston) YTD in February 2011 vs. 2010, in a

further softening of asking prices across all sectors.

Table A

All pre-owned aircraft categories showed large decreases in

average asking price percentages except piston helicopters, with an

increase of 5.2%. The decreases in average asking price ranged from

-26.9% for business jets to -14.5% for business turboprops and

-19.2% for turbine helicopters.

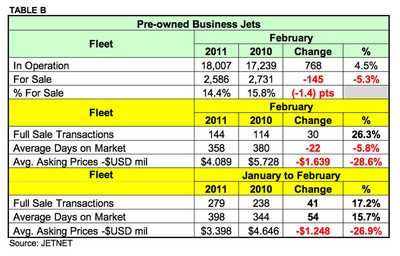

The build-up in Business Jet For Sale inventory decreased to

2,586, or 14.4%, in February 2011 from 2,731, or 15.8%, in February

2010. The Business turboprop market continues to hover just under

the 1,400 for sale inventory level, down to 10.7% in February 2011

from 11.1% in February 2010. So the company says that makes for

stubbornly high levels of for-sale inventories as we remain in a

buyer’s market, with business jets showing for-sale

percentages greater than 10%. A seller’s market is when 10%

or less of the pre-owned business jets are for sale.

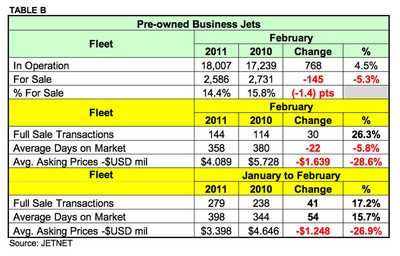

Looking at the business jet results for February 2011 compared

to February 2010 (Table B), inventory continues to decline with

full sale transactions increasing by 26.3% for February 2011. This

increase is a positive sign but unfortunately at much lower prices

(down 28.6%). In comparing the YTD figures for February 2011,

asking prices remain soft (down 26.9%) and the length of time on

the market, at 398 days, is about 2 months longer (54 more days)

than in the comparable YTD period for February 2010.

Table B

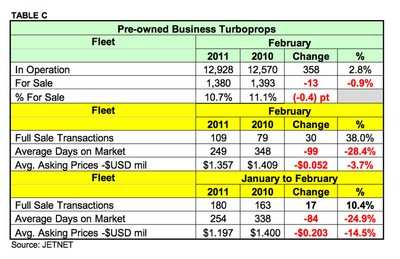

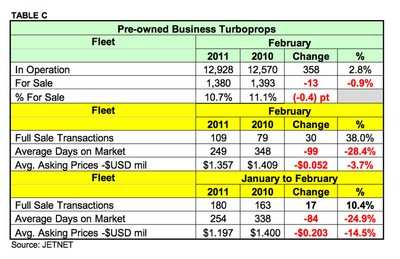

The business turboprop results for February 2011 (Table C),

compared to February 2010, indicates the average asking price has

declined by 3.7%, to an average of $1.357 million. Average Days on

Market has been shortened by 99 days to 249 days. However, the good

news is that the business turboprop market saw a large percentage

change in February, increasing by 38%. The YTD Full Sale

Transactions figure for February 2011 saw an increase of 10.4% (and

in fewer days on the market), but at a 14.5% decline in the average

asking price.

Table C

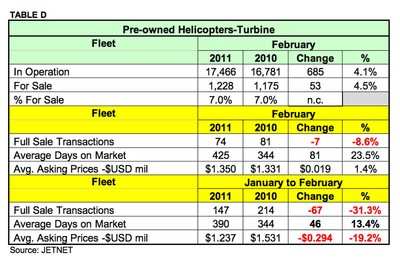

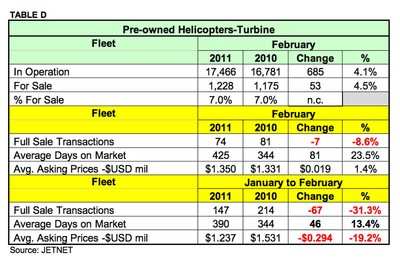

There was no change in the number of pre-owned turbine

helicopters for sale in February 2011, holding steady at 7.0% (a

buyer’s market) when compared to February 2010 (Table D). A

buyer’s market in the helicopter world is when the percentage

of helicopters for sale exceeds 5% of the fleet. The number of

pre-owned Full Sale Transactions for turbine helicopters declined

by 31.3% YTD in February 2011 compared to 2010. Average Days on

Market for turbine helicopters was 390 days, 46 days longer on the

market than during the same period in 2010. However, the average

asking price fell by 19.2% YTD in February 2011 compared to

February 2010.

Table D

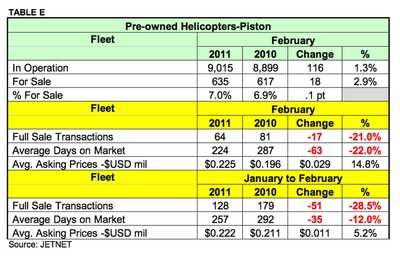

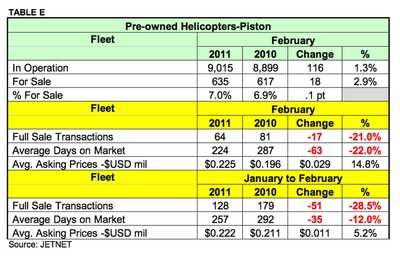

The number of pre-owned piston helicopters for sale in February

2011 (excluding Russian-built aircraft) was 635 helicopters, or

nearly half the number of turbine helicopters (Table E). The

percentage for sale of 7.0% in 2011 (a buyer’s market) was

nearly the same as the 6.9% seen in February 2010. The number of

pre-owned Full Sale Transactions for piston helicopters decreased

by 21% in February 2011 compared to February 2010. Average Days on

Market for piston helicopters was 224 days, 63 days less in 2011

than in 2010. However, the average asking price for piston

helicopters jumped by 14.8% in February 2011 compared to February

2010.

Table E

The YTD average asking price increase of 5.2% has resulted in

28.5% fewer Full Sale Transactions. However, the Average Days on

Market has declined by 35 days.

ANN's Daily Aero-Linx (04.15.24)

ANN's Daily Aero-Linx (04.15.24) Classic Aero-TV: 'No Other Options' -- The Israeli Air Force's Danny Shapira

Classic Aero-TV: 'No Other Options' -- The Israeli Air Force's Danny Shapira Aero-News: Quote of the Day (04.15.24)

Aero-News: Quote of the Day (04.15.24) Airborne 04.16.24: RV Update, Affordable Flying Expo, Diamond Lil

Airborne 04.16.24: RV Update, Affordable Flying Expo, Diamond Lil ANN's Daily Aero-Term (04.16.24): Chart Supplement US

ANN's Daily Aero-Term (04.16.24): Chart Supplement US