Analysis: Complex Legal Documents Seem To Suggest More

Questions Than They Answer

ANN is poring through over an inch

thick stack of documents sent to shareholders of the Cirrus

Aircraft program in the last few days. The deal, claiming a

purchase price of "$210,000,000" sounds impressive until wading

through over 100 pages of associated documentation to note that the

$210M figure is 'minus the estimated "Net Debt", which means an

amount equal to the difference between:'

ANN is poring through over an inch

thick stack of documents sent to shareholders of the Cirrus

Aircraft program in the last few days. The deal, claiming a

purchase price of "$210,000,000" sounds impressive until wading

through over 100 pages of associated documentation to note that the

$210M figure is 'minus the estimated "Net Debt", which means an

amount equal to the difference between:'

- an amount equal to the sum of:

- the current portion of long-term debt, plus

- short-term notes payable, plus

- long-term debt, plus

- certain capital lease obligations, plus

- certain accrued expenses, plus

- any amounts owed to the Parent and Sellers' Representative

pursuant to pre-Closing funding of the Company's working

capital;

minus

- the aggregate amount of cash and cash equivalents of the

Company Group,

as each of the above is reflected in the relevant balance sheet

prepared in accordance with the Merger Agreement,

- minus the estimated "Specific Deductibles", which

means an amount equal to:

- the unfunded product liability of the Company (accrued product

liability minus restricted cash and short-term investments),

plus

- certain customer deposits, plus

- certain accounts payable, plus

- certain accrued expenses, plus

- the proceeds to be paid under the Company's liquidity bonus

plan and the Company's supplemental bonus plan, plus

- all past due rent, penalties, and interest as of the date on

which the Closing occurs (the "Closing Date") under the amended

lease by and between the City of Grand Forks, North Dakota, Dakota

Aircraft Corporation, and the Company;

- minus the estimated "Outstanding Transaction Expenses", which

means the legal, accounting, financial advisory, and other

third-party advisory or consulting fees and expenses incurred by

the Company Group or the Sellers' Representative in connection with

the Merger Agreement and the transactions contemplated thereby

(including any Outstanding Transaction Expenses that will become

payable after the Effective Time with respect to services performed

or actions taken prior to the Effective Time) to the extent not

paid at or prior to the Closing.

Get all that? For those of you not familiar with this level of

financial discourse, simply put, while the deal's value (overall)

may encompass a total of $210M... the actual monies paid forth

could be significantly less... once all applicable debts are

satisfied, though we've been told that no matter the outcome, the

parties likely to be made the most "whole" are those associated

with the Majority Shareholder, Arcapita... while the Minority

Shareholders may be less than satisfied with how the deal affects

them (or so we are being told--by some Minority

Shareholders).

ANN is taking additional time to render additional examination

and judgment of the documents and will be relying on those with

financial expertise for an overall evaluation and observations as

to how "good" a deal this may be.

But in the meantime, a number of glaring issues have been

observed in these docs. While we've oft been told that there are

"lies, damned lies and statistics", the Cirrus docs show a pattern

of poor performance at the company that appears to show it reaching

a potentially tragic impasse that also appears to have been

forestalled by the deal with CAIGA... as to how desperate Cirrus

became to 'make a deal, any deal' in order to forestall bankruptcy,

that is yet to be seen/determined -- but the documents prove that

this was a company drowning in debt -- and one that owes

extraordinary sums of money to its long-suffering vendors and

suppliers -- among others. Various aspects of the doc suggest that

the company owed some $30M (as of September 30th, 2010) to a number

of suppliers with other outstanding, larger debts spelled out as

individual liabilities... such as $1.018 Million to the City of

Grand Forks, $1.15 Million to Arcapita for a "Management Fee"

(about which one Shareholder noted, upon reviewing the company's

poor 2008-2010 performance, that he 'wanted his money back...' for

said management), $22.265M to depositors for the moribund Cirrus

Jet program, and so forth.

'Current Liabilities (as of September 30th, 2010) were listed as

$122.602 Million, and Total Liabilities tallied to $174.931

Million. It is not a pretty picture. The report admits that the

company lost a lot of money in 2008, as well as a considerable

amount of money in 2009 (though the amounts vary according to the

type/nature of report and accounting variables).

The result is a picture which strongly suggests that Cirrus had

been managed into a corner for which a financial suitor (and just

about any suitor we would expect), should have been able to suggest

very favorable terms in order to get the company off the Arcapita

balance sheets. The question is... was the Cirrus deal with CAIGA a

"Fire Sale?" And yet, we have heard that some potential investors

were ignored by Arcapita, in favor of the China deal.... if so,

why?

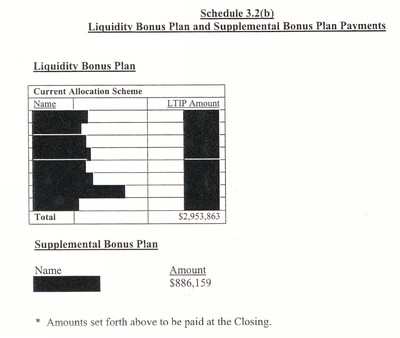

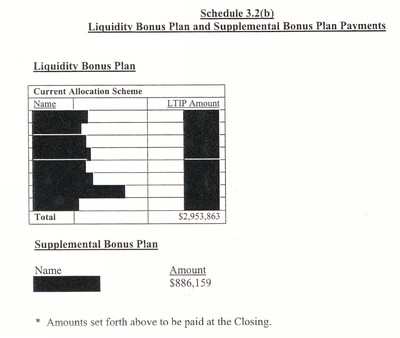

One aspect of the docs that has created a buzz amongst those

with access to same is a page in which the deal proposes to offer

nearly $4 Million in Bonuses for the closing of the sale! Worse

than that, the names of the parties who would received said bonuses

have, literally, been blacked out. Mind you, this is a

Shareholder's report... and we're not quite sure how anyone with a

financial interest in this deal should not be privy to such

ponderous details. Think about it... The company was carrying an

amazing debt load, and pretty much admits that it was in a lot more

trouble than they have otherwise admitted publicly. I am rather

puzzled as to how a company that was led to such poor results (with

full acknowledgement of the ponderous economic issues surrounding

us) would propose to offer nearly $4 million in various bonuses

($2,953,863 under the terms of a 'Liquidity Bonus Plan' and

$886,159 listed as part of a 'Supplemental Bonus Plan' -- all with

the names of the recipients BLACKED OUT) and feel that this was a

proper use of their limited funds. And yet, that is but one of a

number of questions are arising and complicating an already

difficult story to write.

Nearly $4M In Bonuses...

With Names Physically Blacked Out

In addition to all this, information continues to pour into ANN

about the difficulties that vendors, suppliers, customers and

associates of Cirrus have encountered since the latter part of 2008

(when Wouters was in the process of jockeying for control of the

company).

ANN has interviewed a number of parties that allege a pattern of

deception, late (very) payments, broken promises, 'unfair' business

practices, contractual breaches, and other questionable activities

involving Wouters, Vice President of Marketing Todd Simmons, COO

Pat Waddick, and Co-Founder Dale Klapmeier. Additional details

about recent legal actions and actions that are anticipated suggest

that even with a sale on the horizon, that Cirrus' difficulties may

be far from over.

The sale has a deadline (that may be extended by mutual

agreement) of July 30th, 2011... but still must pass muster by the

continued inspection of representatives of CAIGA as well as

possible Federal oversight... which may be more difficult than

Wouters has alleged. At least four lawmakers (Two Senators, Two

Congressmen) have indicated some level of interest in examining

details of this sale/merger... which may delay a sale or make it

impossible to conclude... especially in regards to some recent

ITAR/Tech Transfer issues that have been raised in recent days with

IP that Cirrus may attempt to sell to CAIGA -- and for which

its original inventor/manufacturer reports that Cirrus may not have

the right, regardless of Federal issues, to do so.

ANN continues to attempt to engage Cirrus on these and other

issues to no avail. The most recent attempt resulted in Cirrus

notifying ANN that they would not be honoring the maintenance plan

for our airplane (the same plan confirmed positively the day

before with applicable personnel... UNTIL the matter was reportedly

discussed with CEO Brent Wouters), until ANN agreed to "all of Mr.

Wouters' terms." Sadly, this is not the worst of the actions taken

against ANN since this investigation got underway in earnest last

year. Regardless; ANN remains firm in our belief that the ultimate

arbiter of whether or not the Cirrus/CAIGA merger/sale is a good or

bad deal will depend heavily on how honestly and ethically the

company (Cirrus) has been in the years leading up to the sale with

its critical partners and suppliers -- and how honest they have

been in communicating all this to their counterparts at CAIGA.

Much more info to follow...

ANN's Daily Aero-Linx (04.13.24)

ANN's Daily Aero-Linx (04.13.24) ANN's Daily Aero-Term (04.13.24): Beyond Visual Line Of Sight (BVLOS)

ANN's Daily Aero-Term (04.13.24): Beyond Visual Line Of Sight (BVLOS) Airborne 04.09.24: SnF24!, Piper-DeltaHawk!, Fisher Update, Junkers

Airborne 04.09.24: SnF24!, Piper-DeltaHawk!, Fisher Update, Junkers Aero-News: Quote of the Day (04.14.24)

Aero-News: Quote of the Day (04.14.24) ANN's Daily Aero-Term (04.14.24): Maximum Authorized Altitude

ANN's Daily Aero-Term (04.14.24): Maximum Authorized Altitude